A Client will decide which secondary options to include within a specific contract. By including a secondary option or indeed deciding not to include it will in some way be altering a Contractor’s risk profile. One of these such choices is whether or not to include X1, Price Adjustment for Inflation. This is only an option to include where the main ECC option is either A, B, C or D. X1 is not used for option E which is a pure cost reimbursable contract. If X1 is included, it allows during the project an adjustment for inflation, which clearly reduces the Contractor’s risk where such an inflation increase is likely.

Increased risk of inflation: Industry is currently experiencing an unprecedented level of volatility in the supply of materials and resource with massive increases in material costs arising. The challenge for the Contractor is how they manage this inflation risk when pricing work in a competitive market whilst trying to maintain the economic sustainability of their organisation. This could mean massive increases to tender prices or even Contractors not bidding at all. With option X1 there is a mechanism to increase costs in line with agreed indices for inflation. Previously with years of low inflation, it has been possible for a Contractor to price that risk with a nominal increase in their price. However, that is not the case now, and Contractors now view that risk much more significantly and are not keen to have to guess what might happen to inflation.

Contractor risk without X1: For options A&B, on their original contract work the Contractor carries all of the risk of inflationary increases in the cost of labour plant and materials etc. For options C&D, the risk of inflation is initially borne by the Client as they will be paying the Contractor’s Defined Cost. However, this will subsequently be shared through the pain/gain calculation at the end of the project, as the target will not be changing due to inflation. Compensation events will generally be priced at open market rates for options A-D so increased material prices can be claimed for against new instructed works. For options E&F the Contractor is paid all its Defined Cost and has no risk of inflation. Hence X1 is not included as a secondary option in main options E&F.

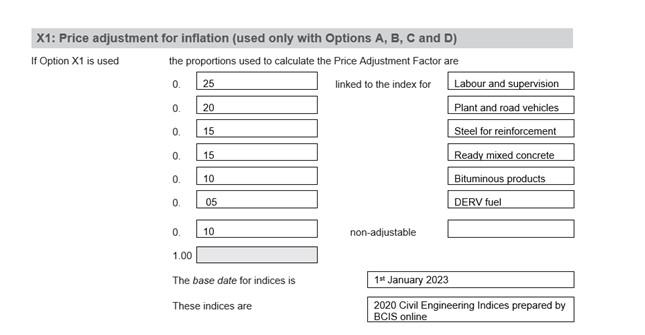

Including X1 as an option in Contract Data part one: The source of the published priced indices to be used will be stated in Contract Data part one, including the proportions of the total value of the works to be linked to each category. There is a non-adjustable portion which represents the proportion for which the Contractor will be responsible for the risk. This is meant to be set at a nominal amount so that the effect is not a penalty to the Contractor, and guidance recommends this is set at a maximum of 0.1 times the overall cost (i.e. the Contractor will be retaining 10% risk of the overall change due to inflation). The total of these proportions must add up to “one”. Also identified in Contract Data will be the ‘base date’ for the indices, which will typically be set a few weeks before the intended date for the submission of the tender.

Price Adjustment Factor: At each assessment date, if there is a change in the stated indices, this will be taken into account by adjusting the prices by the Price Adjustment Factor (PAF). The formula then used is:

PAF= total of the products in each proportion stated in Contract Data multiplied by (L-B)/B for the index linked to it, where L is the Latest Index and B is the Base Index.

Clients need to ensure that relevant price indices are chosen to ensure the model of inflation is appropriate for the contract. The indices used at any point in time are the latest available at the time of assessment. If only one category changed in a single period and it increases by 5%, but the proportion against that category is 0.2, then the resultant increase that period for the amount due would be the equivalent of a 1% increase.

Given that Clients will normally be choosing the indices and the proportions used to calculate the Price Adjustment Factor, a Contractor needs to ensure that they reasonably reflect the elements and proportions of their priced works. If not, like any such matters at tender stage they either need to try to negotiate different categories/proportions. If they do not, they will have to price the risk of a gap between the proposed model of inflation and how inflation will actually impact on their costs.

The Price Adjustment Factor is frozen at the Completion Date, so the Contractor takes the risk on any further inflation after this date.

Example Contract Data part one entry for X1 inflation:

Adjustment amount for options A & B: If the increase in the Price for Work Done to Date for a period is £50,000, and the Price Adjustment Factor (PAF) is 0.05, the additional amount that period to be paid will be £50,000 x 0.05 = £2,500.

Adjustment amount for options C & D: Whilst the Contractor is being paid Defined Cost, which is close to “actual cost” during the life of a project which will include the effects of any inflation, a slightly different calculation is necessary to adjust the total of the Prices (the target). If the increase in the Price for Work Done to Date in a period is £50,000 and the Price Adjustment Factor (PAF) is 0.05, the calculation is (£50,000 x 0.05)/1.05 = £2,380.96

Should Clients choose X1 going forward? In the current market an astute Contractor is likely to try to insist on having X1 included at tender. It could be considered too risky for a Contractor not to have it and attempt to include a risk allowance. Clients might need to think smarter and different now and could even pre-order materials and equipment to lock in prices and then “free-issue” to the Contractor. This will help to mitigate inflation later and give all involved a bit more price certainty.

What is not recoverable in terms of inflation? X1 is just about price adjustment and does not address the effects things like delay and disruption resulting from ‘supply issues’ due to increased demand. This would remain as Contractor risk, unless the resultant delay and disruption fits a reason that would be claimable as another compensation event. To be protected from such a risk the Contractor would need a carefully worded additional compensation event.

Summary: It is likely that the use of X1 will be more common for the foreseeable future with

- Contractors unable or unwilling to take on the risk of inflation, and

- Clients recognising the collaborative need to appropriately balance project risk.

More considered planning by Clients to choose the appropriate indices and not just relying on for instance the retail price index will help support more sustainable outcomes for all parties involved. This approach is already commonplace on international contracts where tenderers are routinely required to quote indices and weightings on costs in their own currency.